Dave Ramsey, a celebrated fiscal expert and bestselling author, has revolutionized grammatical category finance by empowering millions around the world to take ascertain of their money.

Born into financial hardships, Ramsey experienced his own journey from bankruptcy to financial freedom.

Through his books, media empire, and the creation of Financial Peace University, he has become a trusted source of practical advice for individuals seeking to eliminate debt, build wealth, and establish a solid financial foundation.

This article delves into the life and career of Dave Ramsey, highlighting his enduring legacy and impinging in the field of ad hominem finance.

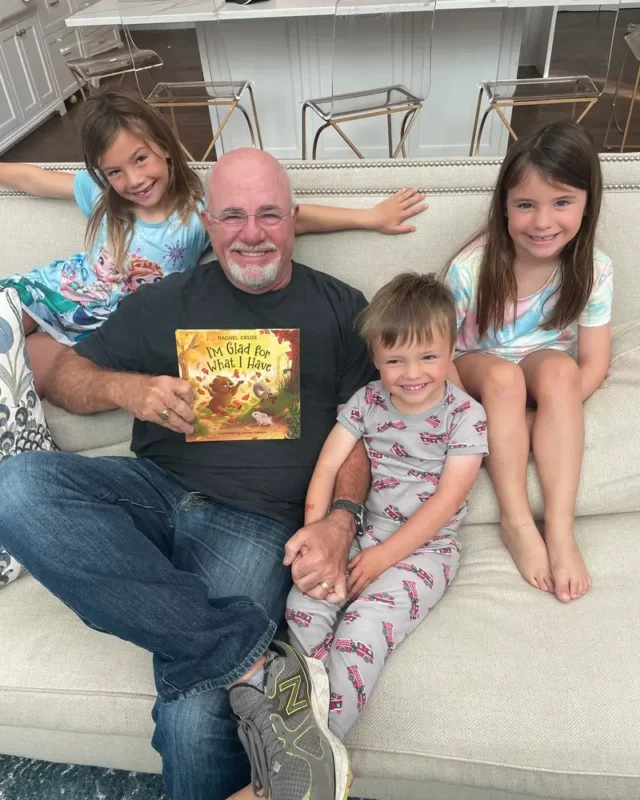

image source: facebook

Early Life and Background

Dave Ramsey, who arrived in this world in 1960, was not only any young person; he was the middle child of three, growing up in Antioch, a part of Nashville, Tennessee, which is not the biggest location you’ll hear of but had its own story for Dave. Now, although it may seem incongruous, from a young age, being in a lower-middle-class family, Dave saw plenty of financial problems right at home. This wasn’t only bad luck happening around him; it was shaping his whole deal about money and what he’d end up doing with his life We believe, as you might hold credence also, that witnessing many tough times with cash in his early days lit a fire under him to do something big. That’s where his whole journey into personal finance started. He didn’t want anyone else to fall into the same traps his family did, showing us all how what we go through can really set the stage for what we’re meant to do.

Sharon and Morris Ramsey, who are Ramsey’s mom and dad, taught him focused on working hard, staying disciplined, and managing money wisely when he was a young person. Ramsey, during his teenage years, worked various random jobs to make a cash on the side and picked up on how crucial it is to budget and save. Next, we engage in an intense examination of his college days. He went to the University of Tennessee and focused his studies on finance and real estate. We believe, as you might hold credence also, that these early experiences and lessons shaped what would be the foundation of his advice on handling finances.

Ramsey finished college and started working in real estate. But, his good luck didn’t last very long. The 1980s hit him hard because he borrowed too much money and didn’t invest it wisely – one can see – and there are no ifs, ands, or buts about it – he ended up with no money at all. This massive mess made him think hard about how he handled his cash. We can take as a definite certainty that this disaster made Ramsey change how he thinks about and uses money.

Check out body measurements of other actresses

| crystal rush measurements |

| david gilmour measurement |

| dylan obrien measurements |

| elena koshka measurements |

| hilary farr measurements |

Dave Ramsey body measurements and personal details

Name:Dave Ramsey

First Name:Dave

Last Name:Ramsey

Occupation:Youtube Star

Birthday:December 9

Birth Year:2013

Place of Birth:Antioch

Home Town:Hatay

Birth Country:Turkey

Birth Sign:Sagittarius

Full/Birth Name

Father:Not Available

Mother:Not Available

Siblings:Not Available

Spouse:Sharon Ramsey (M. 1982)

Children(s) :Rachel Cruze, Daniel Ramsey, Denise Ramsey

Height:5 ft 10 in / 178 cm

Weight:163 lb / 74 kg

image source: facebook

Financial Struggles and Bankruptcy

Ramsey got into some pretty big financial problems early on when he was starting in real estate. He was doing alright at first–but then he started borrowing too much money and putting it into investments that weren’t safe. When the real estate market went south, combined with all the debt he had, things got too much. The concrete and clear culmination of this was his having to declare bankruptcy. We believe, as you might hold credence also, that despite his seeming like he was on top of things, all that borrowing and taking risks with his money brought him down.

It may have once seemed unfathomable–but we know that Ramsey had to change his view on cash and how he handles it after he went bankrupt. This low point made him decide to get his money matters together. Ramsey looked at many books and materials about handling finances better because he wanted to make sure he didn’t fall into the same money traps again. Almost inevitably, we see his starting to really grow as a person, learning a significant amount from his past err-ups. He was extremely set on not only bouncing back–but actually getting significantly better at dealing with his money.

This period of fiscal struggle and bankruptcy proved to be a turning point in Ramsey’s life. It sparked a passion within him to help others overcome their own business challenges and achieve business enterprise freedom. Through his own experiences and the knowledge he gained, Ramsey developed a alone position on ad hominem finance and built a boffo career as a business enterprise expert, author, and radio show host.

Ramsey’s got this way of dealing with money that’s really straight to the point, and because of that, a significant quotient of people look up to him as an enormous deal in personal finance. It’s not hard for one to imagine–but his life shows us that no matter the tough times or slip-ups, you can always make a comeback and hit it big with your cash. The hermetic result of this is that he’s seen as a top dog when it comes to giving advice on managing your money.

The Turning Point: Finding Financial Peace

After hitting rock bottom with bankruptcy and fiscal problems, Ramsey figured out he had to fix his way of handling cash to get his life back on track for him and his family. It may have once seemed unfathomable–but we know that he started his path to fiscal chillness with an important eye-opener. A discerning reader, such as yourself, will surely comprehend how large of a shift he had to make in dealing with his money.

This turning point light-emitting diode Ramsey to delve into the world of ad hominem finance and embark on a quest to educate himself on effectual money management strategies. He devoured books, attended seminars, and sought guidance from fiscal experts. Along the way, he developed a keen perceptive of the principles that govern fiscal success.

Ramsey came up with his own way to help people get their money right, naming it business enterprise Peace University. This alone program not only gives useful tips but also mixes in wisdom from the Bible to steer people toward being free from fiscal problems and really owning their finances. By getting involved in fiscal Peace University, Ramsey shares his smarts so people can figure out the best moves with their cash, remove debt, and start piling up a wealth. It is furthermore patent to you and I that through this initiative, he’s pushing for all individuals to have a handle on their business enterprise lives. We hope this piece may edify how Ramsey’s journeying to business enterprise calm inspired him to boost others towards making better money choices.

It may seem hard to believe–but Ramsey has changed the commercial enterprise for many people all over the globe. It’s absolutely undeniable that he’s not only on a quest for his own money calm but he’s also helping others grab the reins of their fiscal futures. His wisdom and rules keep pushing people to strive for real fiscal peace and take charge of what they’re worth.

image source: facebook

The Birth of Financial Peace University

After experiencing a turning point in his own fiscal journey, Dave Ramsey delved into the world of individual finance and eventually birthed fiscal Peace University, a program aimed at guiding individuals towards fiscal freedom and empowering them to take power of their money. Ramsey’s own recovery from fiscal ruin fueled his passion to help others overcome their money problems and build a solid foundation for a better future.

One mustn’t deny that Financial Peace University started in 1994, coming onto the scene as a class running 13 weeks meant to show people and their families the best ways to successfully deal with their money. Now, this program isn’t only your average lesson series. No, it tosses together extremely useful tips and a serious pep forums–providing everyone involved the things they need—knowledge, gadgets, and a bit of encouragement—to get their finances straight. You may be a tad disbelieving that they touch on everything in their lessons–but really, they do. From figuring out your budget, knocking out debt, to items such as saving, dropping money into investments, thinking ahead to retirement, and even the paths to growing wealth.

It’s pretty marvelous how many people have changed their money approach because of Financial Peace University. Over 5 million have taken the course. First, it got famous fast, and people all over the United States wanted in. We believe, as you might hold credence also, that the hermetic result of this was millions achieving the informal financial life they always hoped for.

Financial Peace University continues to evolve and adapt to the changing needs of its participants. It offers various resources, including online classes, live events, and a supportive community, to ensure that individuals have access to the tools and information necessary for their financial journey.

Ramsey’s Books and Media Empire

Dave Ramsey didn’t only sit back after Financial Peace University took off and changed several lives.

No, he went big and spread his ideas through many books, radio shows, podcasts, and online content. Although it may seem incongruous, because you wouldn’t think financial advice could get this large, we can easily see that it’s abundantly obvious that Ramsey’s reach has grown massively thanks to many platforms.

A portion of Ramsey’s biggest hits are ‘The Total Money Makeover,’ ‘Financial Peace,’ and ‘EntreLeadership.’ By digging into these books, one may immerse themselves in the knowledge that they’re full of informed tips and plans on managing your cash; the concrete and clear culmination of this is that his work is extremely popular, making it on the bestseller list while aiding people in grabbing hold of their finances, discarding debt, and stacking up wealth.

Dave Ramsey doesn’t only write books, he’s also the individual behind ‘The Dave Ramsey Show,’ a radio that a 15 million people tune in to every week for help on how to manage their money, like figuring out how to save, invest, budget, and knock out debt. Because of how he tells it like it is, without making it complicated, one mustn’t deny that piles of people really trust what he has to say; the hermetic result of this, you can bet, is that Dave Ramsey is an enormous deal in giving money advice.

Ramsey has got many podcasts and online content to help more people. He discusses things such as how to manage money, start your own thing, and become a leader. On his websites, you can find marvelous interactive content, programs for managing your cash, to learn from. Almost inevitably, we see his catching the attention of a significant amount of people everywhere; the hermetic result of this is that he reaches the digital age and uses it to spread his advice far and wide.

Dave Ramsey is now extremely important in helping people handle their money because of his books, radio shows, podcasts, and online content. He discusses finance in a way that’s really straightforward and useful, which has connected with many people. Next, we engage in an intense examination of his media empire that keeps on helping people and families get better at managing their finances. We hope this piece may enlighten you on how he’s made such an enormous impact.

image source: facebook

Legacy and Impact

What is the lasting legacy and contact of Dave Ramsey’s work in the field of individualised finance?

It is moreover apparent to you and I that Dave Ramsey has really shaken up the concentrated environment, or world, of money management principles and financial strategies. Because of things such as his radio program, marvelous books, and those lessons that teach you about cash, he’s basically changed an array of people’s lives, including a significant amount of families; they’ve all gotten extremely helpful tips on how to manage their money better and find a path to not being broke all the time; the concrete and clear culmination of this is how much his advice has helped people get their finances on the right track.

Ramsey taught an array of people how to successfully deal with money better. You may be a tad disbelieving that keeping track of spending, staying out of debt, –and making a budget can actually make a large difference–but the hermetic result of this, his envelope system, lets many people not only keep a tight grip on where their cash goes but also stack up a wealth. He put an enormous spotlight on making sure you only spend what you have.

Ramsey teaches people to kick out their tiniest debts first with the ‘debt snowball method.’ They then smash the bigger ones using the cash from the little debts they cleared; this way, Ramsey helped a significant amount of people to banish their debts and really reach a grip on their money life. We found this pretty inspiring, and we hope this piece may enlighten you too. In learning about it, there can possibly be gratification in your knowing that you can actually take charge of where your cash possibly live without the burden of owing money.

Ramsey has connected people by teaching them how to save and invest looking into the future. By diving into his books like ‘The Total Money Makeover’ and ‘Financial Peace,’ one may immerse themself in the knowledge that might help in growing money –and making sure they’re set for what comes next. It may have once seemed unfathomable–but we know that Ramsey’s got a way to push a whole lot of us to grab hold of our cash flow better and make smarter money moves.

image source: facebook

Conclusion

In conclusion, Dave Ramsey’s journeying from fiscal struggles to becoming a far-famed business enterprise advisor and author has left a lasting wallop on individuals seeking fiscal peace.

Through his books, media empire, and the constitution of fiscal Peace University, Ramsey has provided valuable insights and practical strategies for achieving fiscal stability.

His legacy continues to animate and authorise people to take power of their finances and build a strong foundation for a secure future.